Cryptocurrency has evolved far beyond its early days, and one of the biggest innovations driving this growth is wrapped tokens. If you’ve ever wanted to use Bitcoin (BTC) on Ethereum or trade assets across different blockchains, wrapped tokens are the solution. These tokens enhance blockchain interoperability, allowing digital assets to move freely between networks. In this blog, we’ll explore what wrapped tokens are, how they work, why they’re important, and what the future holds for them.

What Are Wrapped Tokens?

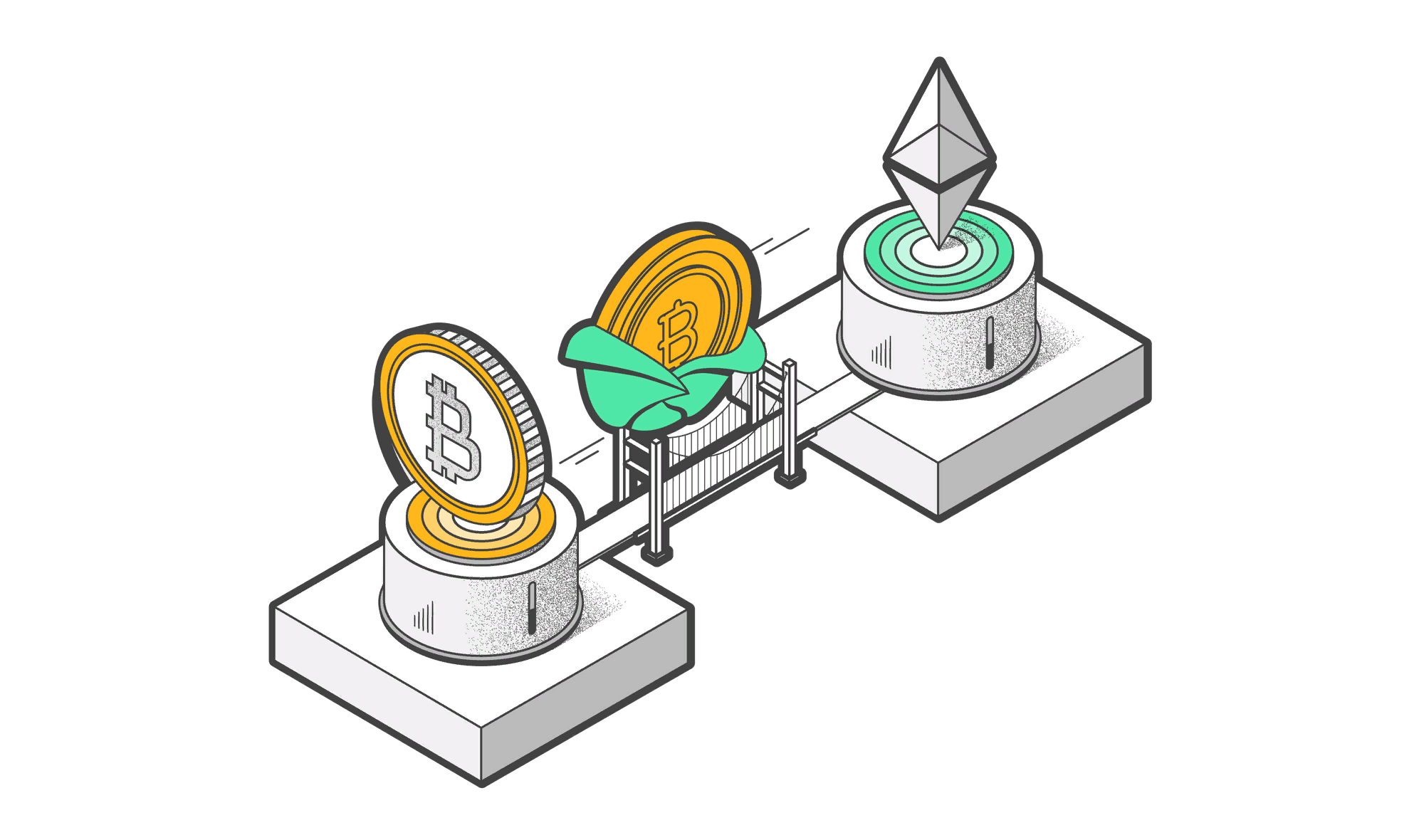

Wrapped tokens are crypto assets that represent another cryptocurrency on a different blockchain. Essentially, they are tokenized versions of a crypto asset that maintain a 1:1 peg with the original asset. This means you can use assets like Bitcoin or Ethereum in ecosystems where they originally wouldn’t be compatible.

How Do Wrapped Tokens Work?

When an asset is “wrapped,” it is locked in a smart contract or held by a custodian, and an equivalent amount of wrapped tokens is minted on the new blockchain. Similarly, when the wrapped token is redeemed, it is burned, and the original asset is released back to the owner.

Examples of Popular Wrapped Tokens

- Wrapped Bitcoin (WBTC) – A tokenized version of Bitcoin that operates on the Ethereum network.

- Wrapped Ethereum (WETH) – An ERC-20 version of Ethereum, enabling better compatibility with DeFi applications.

- renBTC – A decentralized alternative to WBTC, allowing Bitcoin to be used on Ethereum and other blockchains.

How Wrapped Tokens Work

The concept of wrapped tokens is simple yet powerful. Here’s a step-by-step breakdown:

- Depositing the Original Asset: A user sends their asset (e.g., Bitcoin) to a custodian (which can be a smart contract, a centralized exchange, or a protocol like RenVM).

- Issuance of Wrapped Token: Once the custodian verifies the deposit, it mints an equivalent amount of the wrapped token (e.g., WBTC) on the target blockchain.

- Using the Wrapped Token: The user can now trade, stake, or use the wrapped token in DeFi applications.

- Redeeming the Original Asset: When the user wants their original asset back, they initiate the unwrapping process. The wrapped token is burned, and the original asset is released.

This process ensures that wrapped tokens remain fully backed by the original asset at all times, maintaining trust in their value.

Why Wrapped Tokens Are Important

Wrapped tokens solve a major problem in the crypto space: the lack of interoperability between blockchains. Since different blockchains have their own unique protocols and ecosystems, assets are usually restricted to their native networks. Wrapped tokens break this limitation by allowing assets to move across chains seamlessly.

Cross-Chain Compatibility

One of the biggest advantages of wrapped tokens is their ability to enable cross-chain transactions. For instance, Bitcoin holders who want to participate in Ethereum’s DeFi ecosystem can simply use WBTC instead of waiting for Bitcoin-specific DeFi projects to emerge.

Improved Liquidity and Accessibility

Wrapped tokens help increase liquidity in the crypto market by allowing assets to be used across multiple platforms. More liquidity means better price stability, reduced slippage, and smoother trading experiences for users.

Enhanced Functionality

Some blockchains, like Bitcoin, lack smart contract capabilities. By wrapping BTC as WBTC, users can access smart contract functionalities on Ethereum, opening up new use cases like lending, borrowing, and automated trading.

Use Cases of Wrapped Tokens

Wrapped tokens are becoming a key part of the decentralized finance (DeFi) ecosystem. Here are some popular use cases:

Trading on Decentralized Exchanges (DEXs)

Many DeFi platforms operate on Ethereum and only support ERC-20 tokens. Wrapped tokens like WBTC allow Bitcoin holders to trade on these DEXs without needing to convert their BTC into ETH.

Yield Farming and Staking

DeFi protocols often offer rewards to users who provide liquidity. Wrapped tokens enable users to stake their assets and earn rewards while maintaining exposure to their original investments.

Cross-Chain Lending and Borrowing

Platforms like Aave and Compound allow users to borrow against their crypto holdings. With wrapped tokens, users can leverage their BTC or other assets as collateral without leaving the Ethereum network.

Risks and Challenges of Wrapped Tokens

Despite their benefits, wrapped tokens come with some risks and challenges that users should be aware of.

Centralization Concerns

Most wrapped tokens rely on a custodian to hold the original asset. If this custodian is centralized, it introduces a risk of fraud, hacking, or mismanagement.

Smart Contract Vulnerabilities

Wrapped tokens are issued and managed through smart contracts, which can be vulnerable to bugs and hacks. If a smart contract is exploited, users could lose their wrapped assets.

Potential Liquidity Risks

In some cases, wrapped tokens may not have sufficient liquidity, leading to high price volatility and difficulty in trading. Users should always check liquidity pools before engaging in transactions.

Future of Wrapped Tokens

Wrapped tokens are expected to play an even bigger role in the crypto industry as blockchain technology advances.

Advancements in Cross-Chain Bridges

More efficient and decentralized cross-chain bridges are being developed to make wrapped tokens more secure and seamless. Innovations like Polkadot’s parachains and Cosmos’ IBC (Inter-Blockchain Communication) will further improve interoperability.

The Rise of Decentralized Wrapping Mechanisms

Currently, many wrapped token systems are centralized. In the future, trustless, decentralized wrapping mechanisms will allow users to wrap and unwrap tokens without relying on custodians.

Impact on the Broader Crypto Ecosystem

Wrapped tokens will continue to drive liquidity, accessibility, and innovation across different blockchain networks. As more projects integrate cross-chain solutions, we can expect even greater adoption and usability of wrapped tokens.

Conclusion

Wrapped tokens are a game-changer in the crypto world. They enable cross-chain compatibility, boost liquidity, and unlock new financial opportunities across different blockchains. However, they are not without risks, and users should always research custodians, smart contract security, and liquidity levels before using them.

As blockchain technology evolves, wrapped tokens will continue to bridge the gap between isolated networks, bringing us closer to a fully interoperable crypto ecosystem. If you’re looking to expand your crypto investment options, exploring wrapped tokens might be the next big step!