In today’s digital world, internet fraud has become an increasing threat to individuals, businesses, and even governments. From phishing scams to identity theft, cybercriminals are finding more ways to exploit the internet for malicious purposes. According to reports, internet fraud is estimated to cause billions of dollars in losses every year. The question many are asking is, can blockchain technology – a solution primarily known for cryptocurrencies – be the answer to fixing internet fraud?

In this blog, we will explore the role of blockchain in combating internet fraud, its real-world applications, and the challenges it faces. By the end, you’ll have a clearer understanding of whether blockchain can effectively prevent online scams and fraud.

Understanding Internet Fraud

Before diving into how blockchain can help, it’s essential to understand the various forms of internet fraud that plague users worldwide. Internet fraud involves any deceptive activity carried out using the internet to steal personal information, money, or assets. Some of the most common forms include:

- Phishing: Cybercriminals send fraudulent emails or messages to trick individuals into revealing sensitive information like passwords, credit card details, or bank account numbers.

- Identity Theft: Cyber thieves steal personal information and use it to impersonate victims, often to make unauthorized transactions or open credit lines.

- Online Banking Fraud: Fraudulent activities related to online banking, including unauthorized access to bank accounts or credit cards.

- E-commerce Fraud: Fake online stores or fraudulent sellers who steal payment details or fail to deliver the purchased goods.

The impact of these activities is far-reaching, resulting in not only financial loss but also damage to reputation, trust, and mental well-being. The increasing frequency and sophistication of these attacks highlight the need for more robust, secure solutions to tackle internet fraud.

What is Blockchain?

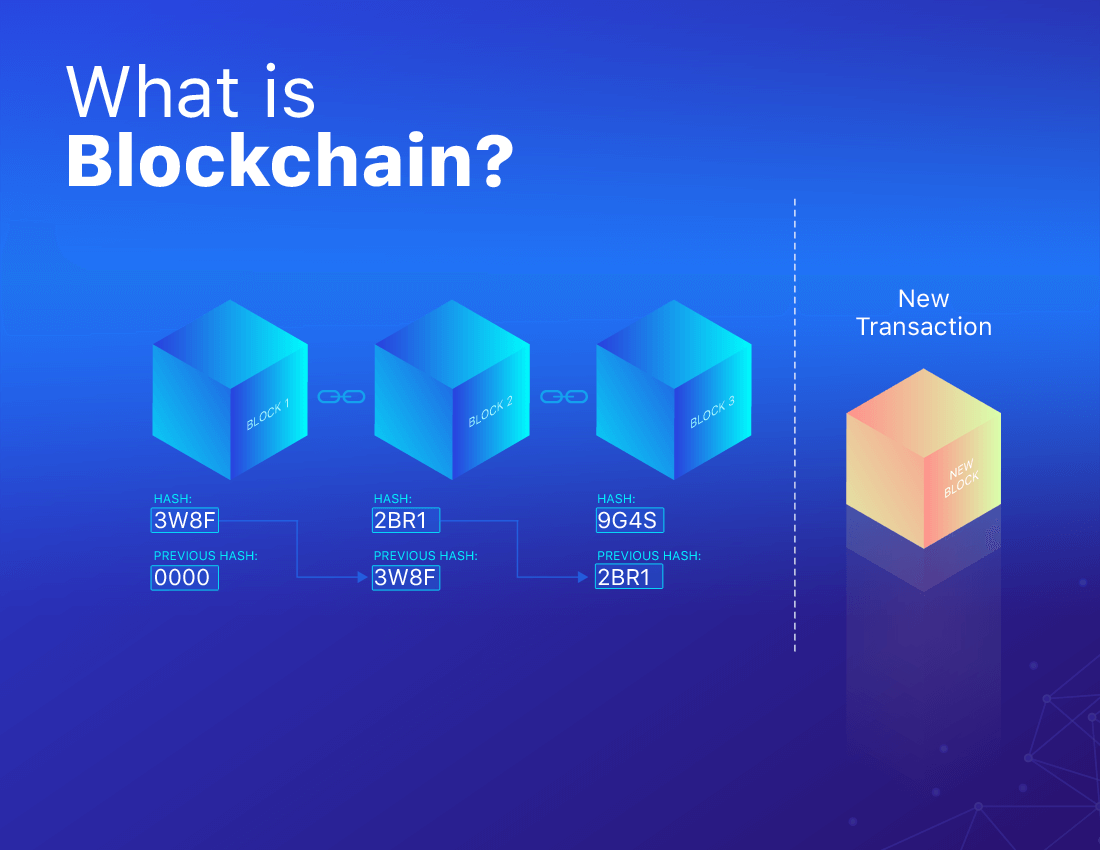

Blockchain technology, at its core, is a decentralized digital ledger system that records transactions across multiple computers in a way that ensures data security, transparency, and immutability. Unlike traditional centralized systems, blockchain operates without a central authority, making it resistant to manipulation and fraud.

Some key features of blockchain technology include:

- Decentralization: There is no central authority controlling the data. Instead, it is distributed across a network of computers, known as nodes.

- Transparency: Every transaction recorded on the blockchain is visible to all participants, making it easy to trace and verify.

- Immutability: Once a transaction is added to the blockchain, it cannot be altered or deleted, providing an added layer of security.

These features make blockchain an appealing solution to many problems, including internet fraud. But how can these characteristics be leveraged to fight fraud in the digital world? Let’s take a closer look.

How Blockchain Can Help Combat Internet Fraud

Blockchain offers a wide range of features that can be instrumental in tackling internet fraud. Below are some ways blockchain can help create a safer online environment:

Transparency and Traceability

One of blockchain’s greatest advantages is its transparency. Every transaction that occurs on the blockchain is recorded in a public ledger. This means that each transaction can be traced back to its origin, providing a clear and accurate audit trail. For instance, when a financial transaction takes place, both the sender and receiver are visible on the blockchain, which reduces the chances of fraudulent activity.

If implemented in online banking or payment systems, blockchain could significantly reduce fraud by making it easier to trace the flow of money. Cybercriminals would find it much harder to execute fraudulent transactions when the information is publicly available and verifiable.

Decentralization

The decentralization of blockchain means that there is no single entity responsible for verifying transactions. This makes it extremely difficult for hackers or malicious parties to manipulate or alter transaction data. Since blockchain networks rely on consensus mechanisms to validate transactions, a fraudulent transaction would need to be approved by a majority of participants across the entire network, which is nearly impossible to achieve.

This feature can be used to eliminate single points of failure that cybercriminals often exploit in centralized systems. For example, when it comes to online banking, instead of trusting a central bank or financial institution to validate transactions, the blockchain network would collectively verify them, making fraud much harder to execute.

Enhanced Security with Cryptography

Blockchain uses advanced cryptographic techniques to secure data. Every transaction on the blockchain is encrypted and linked to previous transactions, making it virtually impossible for anyone to alter the data without being detected. This level of encryption ensures that the integrity of the data remains intact and prevents unauthorized access.

In the context of online transactions, blockchain’s encryption can protect sensitive financial information, such as credit card details or personal identity data, from being intercepted by hackers. Additionally, blockchain’s cryptographic features can help verify the identity of users, reducing the risk of identity theft.

Smart Contracts for Fraud Prevention

Smart contracts are self-executing contracts with predefined conditions written into code. When specific conditions are met, the contract automatically executes the terms without the need for intermediaries. These contracts are stored and executed on the blockchain, ensuring that they cannot be altered once created.

For instance, in the case of an online transaction, a smart contract could ensure that the buyer’s payment is only released to the seller when the goods are delivered. This can reduce the risk of fraud, such as fake online stores or non-delivery of goods. By automating the process and removing human error or dishonesty, smart contracts provide a secure and reliable means of transaction.

Real-Life Use Cases of Blockchain Fighting Internet Fraud

Blockchain is already being used in several industries to prevent internet fraud. Let’s look at some real-life examples of how blockchain is being used to combat online scams and fraud.

Blockchain in Payment Systems

Cryptocurrencies, such as Bitcoin and Ethereum, use blockchain to ensure secure peer-to-peer transactions. By utilizing the transparent, decentralized, and immutable features of blockchain, these cryptocurrencies reduce the risk of fraud in digital payments. For instance, blockchain ensures that once a transaction is confirmed, it cannot be reversed or altered, preventing fraudulent chargebacks that are common in credit card payments.

Additionally, blockchain’s encryption ensures that personal and financial information remains secure, reducing the risk of data breaches that often lead to fraud.

Blockchain in Identity Verification

One of the most promising applications of blockchain in fighting fraud is in identity verification. Traditional identity verification systems, such as passwords, PINs, and security questions, can be easily compromised. Blockchain-based digital identities, however, offer a more secure alternative.

By storing personal data on a blockchain, individuals can control who has access to their information, eliminating the risk of unauthorized access. Blockchain-based identity verification can be used for a variety of online services, from banking to e-commerce, ensuring that the person interacting with a service is who they claim to be.

Blockchain in Supply Chain

Blockchain is also being used to prevent fraud in supply chains. With blockchain’s transparent and immutable ledger, businesses can track every step of a product’s journey from production to delivery. This helps to eliminate fraud in industries like food, pharmaceuticals, and luxury goods, where counterfeit products are often sold as authentic.

For example, a luxury brand can use blockchain to track the provenance of its products, ensuring that customers are receiving genuine items. This transparency not only protects consumers but also helps businesses safeguard their reputation.

Challenges to Implementing Blockchain for Internet Fraud

While blockchain offers a promising solution to internet fraud, there are several challenges to its widespread adoption.

Scalability Issues

One of the major hurdles for blockchain is scalability. As blockchain networks grow, the number of transactions increases, which can lead to slow processing times and higher costs. For blockchain to be a viable solution for internet fraud on a global scale, it must overcome these scalability issues.

Adoption Barriers

Despite its potential, blockchain technology is still relatively new, and many individuals and businesses are hesitant to adopt it. There is a lack of understanding about how blockchain works, and the infrastructure required to implement it on a large scale is still being developed. Overcoming these adoption barriers will be crucial in making blockchain a mainstream solution to internet fraud.

Regulation and Legal Concerns

The decentralized nature of blockchain can make it difficult to regulate, especially when it comes to fraud prevention. Governments and regulators may struggle to create legal frameworks that address blockchain-based fraud while still fostering innovation. This lack of regulation could slow down the adoption of blockchain for fraud prevention.

The Future of Blockchain in Fraud Prevention

Despite the challenges, the future of blockchain in fighting internet fraud looks promising. As blockchain technology continues to evolve, it will likely become more scalable, accessible, and secure. With increased adoption, blockchain has the potential to significantly reduce internet fraud by offering a transparent, decentralized, and secure alternative to current systems.

Collaboration between blockchain developers, governments, and the private sector will be essential in creating a unified approach to combating online fraud. As blockchain matures, it could revolutionize the way we secure online transactions and protect sensitive data.

Conclusion

Blockchain technology has the potential to be a game-changer in the fight against internet fraud. Its transparency, decentralization, cryptographic security, and use of smart contracts make it a powerful tool for reducing online scams and fraud. While there are challenges to its implementation, the future of blockchain in fraud prevention looks promising.

As we continue to navigate the digital age, blockchain may be the key to creating a safer, more secure internet for everyone. So, the next time you think about online fraud, remember that blockchain might just be the solution we’ve been waiting for.